Listen To Article

Listen To Article

The state of Massachusetts has posted its June 2023 revenue report, showing it took a total of $132.8m in taxable gaming revenue for June 2023, down from the $159.6m it reported in May – representing a 20% drop month-on-month.

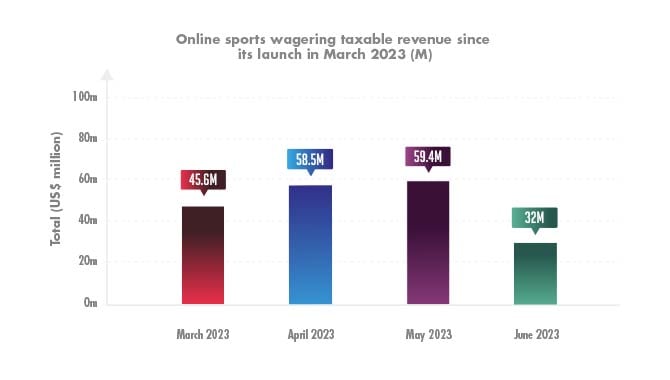

Breaking down the ps, the state’s online sports wagering numbers totalled $32.05m in taxable revenue, a drop against May’s $59.4m.

Online sports betting only launched in Massachusetts in March, meaning that fluctuations in the numbers are to be somewhat expected – despite the expectation that the practice would only increase in the four months since its debut.

The online sports betting drop comes after Massachusetts reported steady growth since March.

The graph shows the sports wagering taxable revenue in Massachusetts since sports betting launched in March 2023

Otherwise, casino table and slots gross gaming revenue (GGR) grew annually to $100.6m, representing an 8% increase from June 2022.

In terms of individual casinos in the state, the Encore Boston Harbor remains the biggest – posting $65.4m in slots and table GGR, an increase of 9% from the $60m it posted in June 2022. The casino collected $30.6m from table games and $34.7m from slots – with the state collecting $16.3m in taxes from that p.

However, while the table and slot games were up, Encore Boston Harbor’s sports wagering revenue dropped month-on-month to $80,592 from $1.3m, representing a 94% collapse.

Since retail sports betting launched in January, Massachusetts has seen the months vary drastically, with April making $364,481 in taxable revenue compared to May’s $1.5m and March’s (which included March Madness bets) $1.4m.

It seems that the launch of sports betting has yet to fully settle in the state that’s famous for its sporting appetite, which may come as a shock to some – as sports betting was seen to be a source of consistent taxes for Massachusetts. But for the moment, it remains in its infancy – something reflected in its financial reports.