Listen To Article

Listen To Article

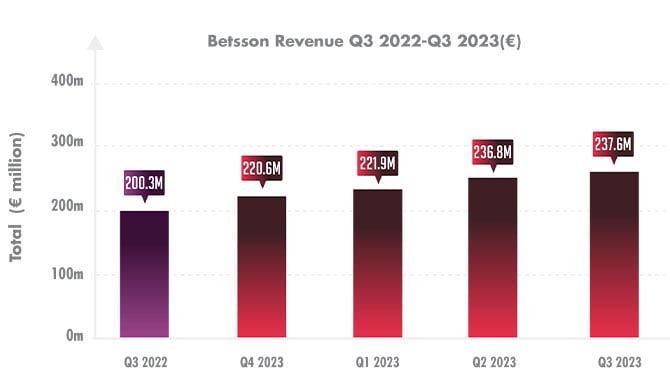

Betsson Group has announced its financial results for the third quarter, which took place between July to September 2023. During its results, Betsson experienced the seventh quarter in a row with back-to-back growth in revenue.

The operator reported Q3 revenue of €237.6m ($250.6m), up 19% within the same period in 2022. Additionally, there was an organic increase of 39%.

Betsson also saw a 17% rise in gross profit to €156.6m.

Of that revenue, casino revenue made up €172.1m, increasing by 27%, although sportsbook revenue only increased by 2% to €63.3m. Meanwhile, sportsbook gross turnover increased 24% to €1.3bn.

Net income and EBITDA both saw the same percentage growth of 42% year-on-year, with net income rising to €46.2m and EBITDA increasing to €68.9m.

The graph shows the consecutive growth of Betsson’s revenue over the quarters.

Before the end of the quarter, in September, the group was granted a licence for the locally regulated online casino market in Serbia. In conjunction with this, an online casino offering was launched under the brand name Rizk.

Betsson Group now operates more than 20 brands and holds 23 licences in 23 countries. Due to this, active customers increased by 17% to 1.2 million and, by the end of the third quarter, the number of registered customers was 29.4 million, a growth of 14.7%.

What’s next for Betsson? The group is continually growing and didn’t report any major losses, just back-to-back growth. In September, the group was awarded a licence to offer online sports betting in France. The operations in France will be run in collaboration with a local partner and the launch in the country is expected to take place during the fourth quarter of 2023 under the Betsson brand.

President and CEO at Betsson AB, Pontus Lindwall, commented: “I look forward with confidence to the final sprint of the year. Geographical diversification, a solid balance sheet and strong cash flows create good conditions for continued investments in profitable growth to deliver long-term value creation for our shareholders.”